On March 27, 2020, President Trump signed the CARES Act — a massive $2 trillion dollar stimulus program meant to help businesses and individuals mitigate the financial loss they might be experiencing during the coronavirus pandemic. Yesterday we talked about the ways that individuals might be impacted. Today, we are going to look at what opportunities might be available for business owners through this act. While we’ve discussed this in more detail in previous blog posts, today we will break it down a little more simply, taking a higher level approach. If you want to get into more details, check out our previous posts where Jason Schneider, CPA, breaks it down more in depth.

How business owners benefit:

1) Paycheck Protection Program (PPP)

The SBA released a program designed to incentivize employers to keep their employees employed and on payroll, called the Paycheck Protection Program (PPP), which is administered by commercial banks and lending institutions. This is an incredibly popular program because, while it starts out as a loan, it can become fully forgivable as a grant up to $10 million dollars.

How it works is, the PPP allows businesses to obtain loans of 2.5x their average annual payroll and have those loans forgiven if they spend at least 75% of those funds on “payroll costs” within eight weeks of receiving the loan. The forgivable portion of the loan is reduced or eliminated if the business does not hire back their full team, or reduces their salary. However, whatever portion of the loan needs to be paid back, will be deferred for 6 months, with the loan maturing in 2 years at just a 1% interest rate.

Check with your local lender if this is something you might want to apply for. You may want to act soon as possible as Wells Fargo has already announced this past Monday that they’ve already maxed out and can no longer accept PPP applications. You may also want to consider the timing of the loan if your business is closed and there is no work for your employees. Our accounting team is assisting with advising on the timing of the proceeds to maximize loan forgiveness.

Our tax and accounting expert and President of Summit Accounting Solutions, Jason Schneider, CPA, wrote about this program extensively in a recent blog post which can be found here.

2) Economic Injury Disaster Loan (EIDL)

EIDL is the other loan available to small business owners by the SBA created as a response to the coronavirus crisis.

It is important to note a recent clarification that business owners can apply for both the EIDL and the PPP loans but they may not be used to cover the same expenses – aka double dipping.

In addition to the loan amount applied for, the EIDL includes up to a $10,000 forgivable advance. If the loan application is not approved, the $10k advance does not need to be repaid, as long as the business meets the definition and size of small business located in a disaster area.

The maximum EIDL amount is $2 million, but it depends on the amount of financial losses suffered directly from COVID-19 related damages.

3) Optional Social Security Payroll Tax Delay

Businesses that are in a tough position financially can choose to delay the employer part of the social security payroll tax for 2020. Should they choose to do this, it is essentially an I.O.U to the government as they would have to pay it back over the next two years.

As a small business owner, remember you can get through these tough times, and you can take advantage of this massive stimulus bill to get you through. But you need to be aware of the resources that are potentially available to you on the personal level as well. A lot of business owners will be relying on a combination of resources on the business front, and personal front to help keep them afloat financially during this time. Don’t forget to read up on the individual benefits from this package from our blog post yesterday. Click here.

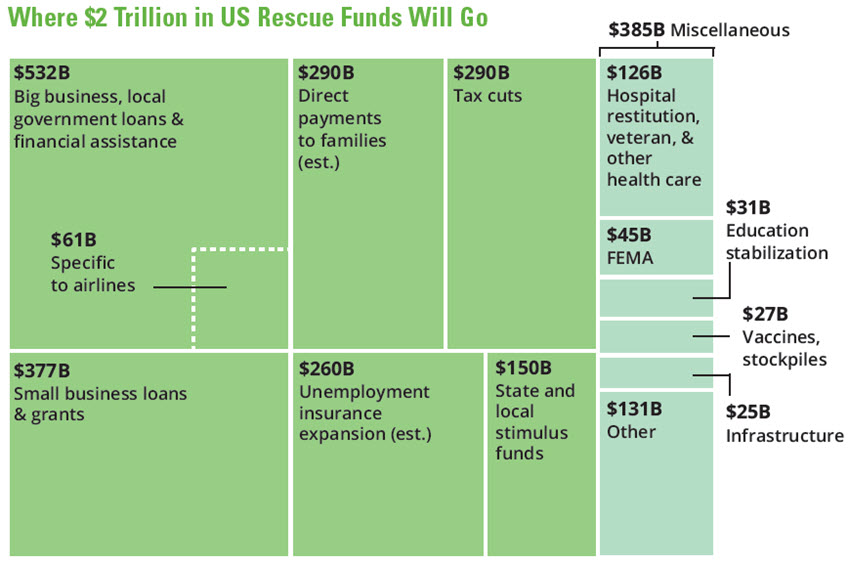

If you are curious how this $2 trillion dollar is being allocated to the various benefits listed here, it breaks down like this:

You must be logged in to leave a reply.